SOFR is published by the New York Federal Reserve every business day for the previous business day, the latest is:

5.31% on June 24, 2024

This was based on $2.0 Trillion of repo transactions where 98% of them used rates between 5.28% and 5.40%.

The resulting overnight LIBOR fallback rate for June 24, 2024 is 5.31644% using the fixed 0.00644% overnight fallback spread.

The latest published SOFR 1-month, 3-month, and 6-month averages are for June 25, 2024. Note these term rates are calculated in arrears (they average historical SOFR rates) as opposed to being forward-looking like swap rates.

| Term | SOFR Average | Fallback Spread | LIBOR Rate |

| Last 30 days | 5.33473% | 0.11448% | 5.44921% |

| Last 90 days | 5.35327% | 0.26161% | 5.61488% |

| Last 180 days | 5.38811% | 0.42826% | 5.81637% |

The latest published SOFR Index is for June 25, 2024: 1.14446837

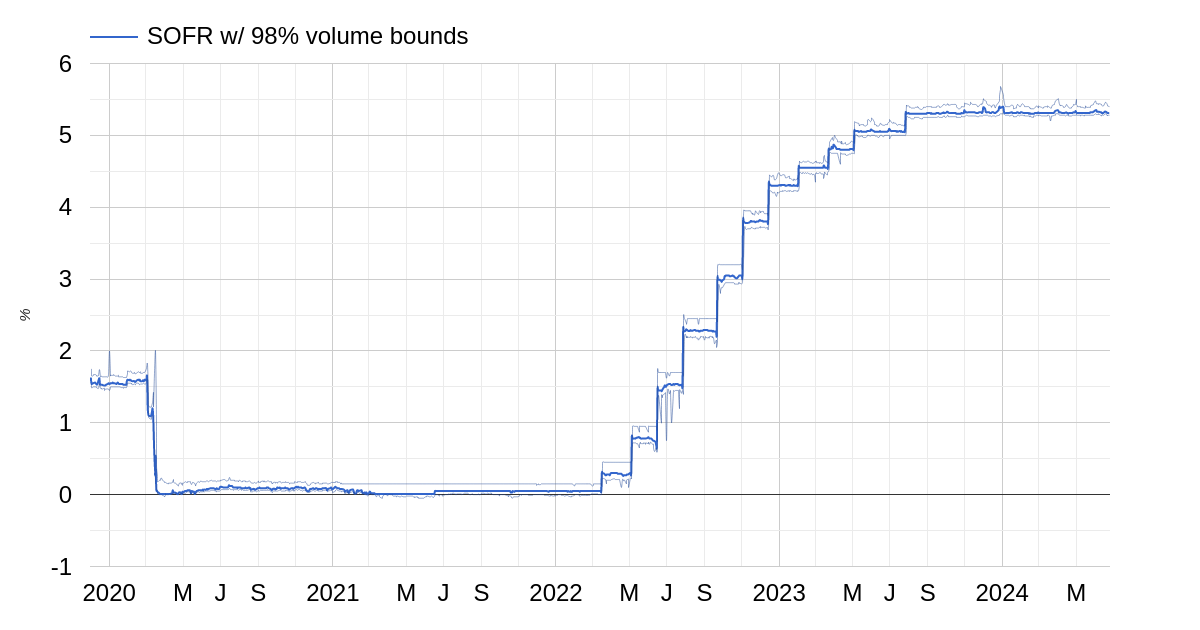

SOFR rate history

SOFR values over last 30 calendar days

Note that the historical averages are calculated in arrears. For example the 30-day average averages overnight SOFR rates over the last 30 days and is not a forward-looking term rate for the next 30 days.

| Historical averages | ||||

| Date | SOFR | 30 day | 90 day | 180 day |

| 2024-05-28 | 5.32 | 5.32433 | 5.34911 | 5.38930 |

| 2024-05-29 | 5.33 | 5.32433 | 5.34922 | 5.38924 |

| 2024-05-30 | 5.33 | 5.32466 | 5.34934 | 5.38891 |

| 2024-05-31 | 5.34 | 5.32433 | 5.34958 | 5.38857 |

| 2024-06-03 | 5.35 | 5.32698 | 5.35057 | 5.38816 |

| 2024-06-04 | 5.33 | 5.32834 | 5.35102 | 5.38833 |

| 2024-06-05 | 5.33 | 5.32901 | 5.35125 | 5.38839 |

| 2024-06-06 | 5.33 | 5.32968 | 5.35147 | 5.38845 |

| 2024-06-07 | 5.33 | 5.33035 | 5.35172 | 5.38851 |

| 2024-06-10 | 5.32 | 5.33233 | 5.35237 | 5.38873 |

| 2024-06-11 | 5.32 | 5.33269 | 5.35249 | 5.38879 |

| 2024-06-12 | 5.31 | 5.33303 | 5.35260 | 5.38884 |

| 2024-06-13 | 5.31 | 5.33303 | 5.35260 | 5.38879 |

| 2024-06-14 | 5.31 | 5.33303 | 5.35262 | 5.38874 |

| 2024-06-17 | 5.33 | 5.33300 | 5.35260 | 5.38861 |

| 2024-06-18 | 5.33 | 5.33370 | 5.35282 | 5.38873 |

| 2024-06-20 | 5.32 | 5.33501 | 5.35327 | 5.38891 |

| 2024-06-21 | 5.31 | 5.33535 | 5.35340 | 5.38892 |

| 2024-06-24 | 5.31 | 5.33501 | 5.35338 | 5.38857 |

LIBOR fallback values over last 30 calendar days

Note that the historical averages are calculated in arrears. For example the 30-day average averages overnight SOFR rates over the last 30 days and is not a forward-looking term rate for the next 30 days. The LIBOR fallback rates are calculated by adding the SOFR rates for each term to the appropriate fallback spreads.

| Historical averages | ||||

| Date | Overnight | 30 day | 90 day | 180 day |

| 2024-05-28 | 5.32644 | 5.43881 | 5.61072 | 5.81756 |

| 2024-05-29 | 5.33644 | 5.43881 | 5.61083 | 5.81750 |

| 2024-05-30 | 5.33644 | 5.43914 | 5.61095 | 5.81717 |

| 2024-05-31 | 5.34644 | 5.43881 | 5.61119 | 5.81683 |

| 2024-06-03 | 5.35644 | 5.44146 | 5.61218 | 5.81642 |

| 2024-06-04 | 5.33644 | 5.44282 | 5.61263 | 5.81659 |

| 2024-06-05 | 5.33644 | 5.44349 | 5.61286 | 5.81665 |

| 2024-06-06 | 5.33644 | 5.44416 | 5.61308 | 5.81671 |

| 2024-06-07 | 5.33644 | 5.44483 | 5.61333 | 5.81677 |

| 2024-06-10 | 5.32644 | 5.44681 | 5.61398 | 5.81699 |

| 2024-06-11 | 5.32644 | 5.44717 | 5.61410 | 5.81705 |

| 2024-06-12 | 5.31644 | 5.44751 | 5.61421 | 5.81710 |

| 2024-06-13 | 5.31644 | 5.44751 | 5.61421 | 5.81705 |

| 2024-06-14 | 5.31644 | 5.44751 | 5.61423 | 5.81700 |

| 2024-06-17 | 5.33644 | 5.44748 | 5.61421 | 5.81687 |

| 2024-06-18 | 5.33644 | 5.44818 | 5.61443 | 5.81699 |

| 2024-06-20 | 5.32644 | 5.44949 | 5.61488 | 5.81717 |

| 2024-06-21 | 5.31644 | 5.44983 | 5.61501 | 5.81718 |

| 2024-06-24 | 5.31644 | 5.44949 | 5.61499 | 5.81683 |

What is SOFR and why was it created?

The 2008 financial crisis underscored the need for a more reliable benchmark than LIBOR, which was vulnerable to manipulation. SOFR, based on the U.S. Treasury repo market, emerged as a sturdy alternative, signifying a move towards more transparent, market-based benchmarks. The Secured Overnight Financing Rate (SOFR) stands as a crucial benchmark in financial markets, representing the cost of borrowing cash overnight, collateralized by Treasury securities. Its advent marks a shift from legacy benchmarks like LIBOR to a more transparent, transaction-based model, enhancing its reliability in financial operations. Overnight financing rates, such as SOFR, are key indicators of short-term borrowing costs. Derived from real transactions, SOFR offers insights into market liquidity and financial stability, reflecting the current state of the lending and borrowing environment.

SOFR is a volume-weighted median rate, calculated from a variety of repo transactions. Repos, or repurchase agreements, involve the sale and later repurchase of securities. SOFR includes General Collateral Finance (GCF) repos, which are standardized repo contracts traded in a specific market segment, tri-party repos, managed by a third party that handles the collateral, and cleared bilateral repos, involving two parties with a central clearinghouse mitigating risk. This diverse mix, secured against U.S. Treasury securities, minimizes risk and differentiates SOFR from unsecured rates like LIBOR. SOFR's calculation uses data from a broad spectrum of repo transactions, ensuring a comprehensive market representation. This variety in data sources contributes to SOFR's stability and reliability, making it a crucial tool for financial decision-making and policy development.

SOFR's establishment, grounded in actual market transactions, marks a significant evolution in financial benchmarks. Its role in providing stability and transparency is growing, poised to become a foundational element in financial markets and shaping a more resilient and transparent financial future.

Major central banks globally have taken on similar reforms to replace their US LIBOR equivalents with more reliable rates.