Hotspot tracking

The current market in Europe is still showing a weak trend, with lower than expected downstream order volumes. Coupled with August being the traditional off-season, there are still doubts in the market about the further upward momentum of prices. Currently, the domestic hot coil prices in Europe are around 640 euros/ton -650 euros/ton EXW (687 US dollars/ton -698 US dollars/ton), with a decrease of about 3 euros/month on month (MoM) and a decrease of about 5 euros/ton. Actual transactions may decrease by 10 euros/ton.

In terms of import market, the current price of hot coils exported from Taiwan, China to Europe is 610 euros/ton CFR Italy, but the price on that day is still high for the whole market. At present, the competitiveness of the Asian hot coil market is relatively high. If the quotation is between 550 and 560 euros/ton CFR (590 dollars/ton -602 dollars/ton), it is very competitive. However, it is still difficult to reach this quotation, and the market is not active at present. It is reported that Ukraine offers a price of 580 euros per ton. The Türkiye market even quoted a price of 640 Euros/ton CFR, which shows that the transaction is not feasible.

[Import and Export Dynamics]

International Market Dynamics

Borcelik, a large plate manufacturer in Türkiye, plans to add a new cold rolling and galvanizing production line

Borcelik, a large plate producer in Türkiye, is currently implementing the capacity expansion plan for cold rolling and galvanizing, and has announced the specific details of the capacity expansion of the project. The project plans to add a cold rolling production line with an annual capacity of 1.8 million tons and a galvanizing production line with an annual capacity of 550000 tons in Bursa Province, the fourth largest city in Türkiye, with a construction area of 125039 square meters (the planned enclosed area is 63567 square meters), and an estimated investment amount of 9.82 billion Türkiye lira (about 300.5 million US dollars). It is reported that two-thirds of this amount will be used to purchase instruments and equipment.

According to Mysteel, Borcelik, founded in 1990, is Türkiye's first private and second largest plate manufacturer, with more than 1200 employees and an investment of more than 530 million dollars. At present, Borcelik is the largest galvanized steel producer in Türkiye, with three cold rolling and three hot galvanizing production lines, with an annual capacity of about 1.5 million tons, including 600000 tons of cold rolled steel and 900000 tons of galvanized steel. This planned project will also help Borcelik to further expand its capacity.

Tokyo Iron and Steel Corporation Restarts Hot Coil Production Line

The steel plant located in Tanabara City suspended operations after an explosion on May 25th. The estimated production of hot coils affected by the shutdown is about 60000 tons. Although its 420 ton electric arc furnace was not affected, the accident caused damage to auxiliary equipment.

With the restart, Tokyo Iron and Steel Co., Ltd. has raised the domestic H2 grade scrap steel prices at the Taghara and Nagoya scrap yards by 1500 yen/ton (equivalent to 9.5 US dollars) to 51000 yen/ton and 50000 yen/ton, respectively, effective June 18th. The overall hot coil production of the company is approximately 140000 to 150000 tons per month.

Normal operation of NLMK steel plant in Russia after accident

On June 17, 2024, Ukrainian drones attacked the Novolipetsk Iron and Steel Works located in western Russia. NLMK stated that the steel plant is currently operating normally and there have been no casualties.

New Lipetsk Steel Plant is the first steel plant in Russia to be attacked by Ukrainian drones since the Russia-Ukraine conflict. The steel plant mainly produces civilian steel, and since the beginning of 2024, the steel has suffered a total of four attacks. According to the latest data from the New Lipetsk Steel Plant (2021), its production capacity is 14.2 million tons, with a steel production of 13.4 million tons in 2021.

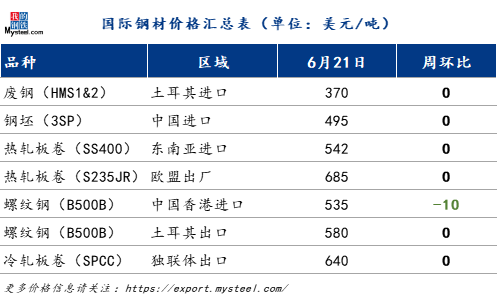

International Price Summary

Information editor: Zhang Xiang 021-26093741

Information supervision: Records 021-26098231

Information complaint: Chen Jie 021-26093100

Disclaimer: Mysteel strives for the accuracy of the information used, the objectivity and impartiality of the content and viewpoints expressed in the information, but does not guarantee whether necessary changes need to be made. The information provided by Mysteel is for customer decision-making reference only and does not constitute direct advice on customer decisions. Customers should not use it as a substitute for their independent judgment, and any decisions made by customers are not related to Mysteel. This report is copyrighted by Mysteel